This article explores the latest EV statistics, offering a deep dive into the electric vehicle (EV) market’s growth over the past decade. Highlighting global trends and regional developments in the U.S., Europe, and China, it sheds light on the significant increase in EV sales and the rising electricity demand that accompanies this growth.

Through analysis of data from a range of authoritative sources, this article presents an insightful overview of the EV industry’s evolution, demonstrating the shift towards sustainable transportation. It serves as a key resource for understanding the EV market’s current dynamics and future potential.

EV Statistics Highlights

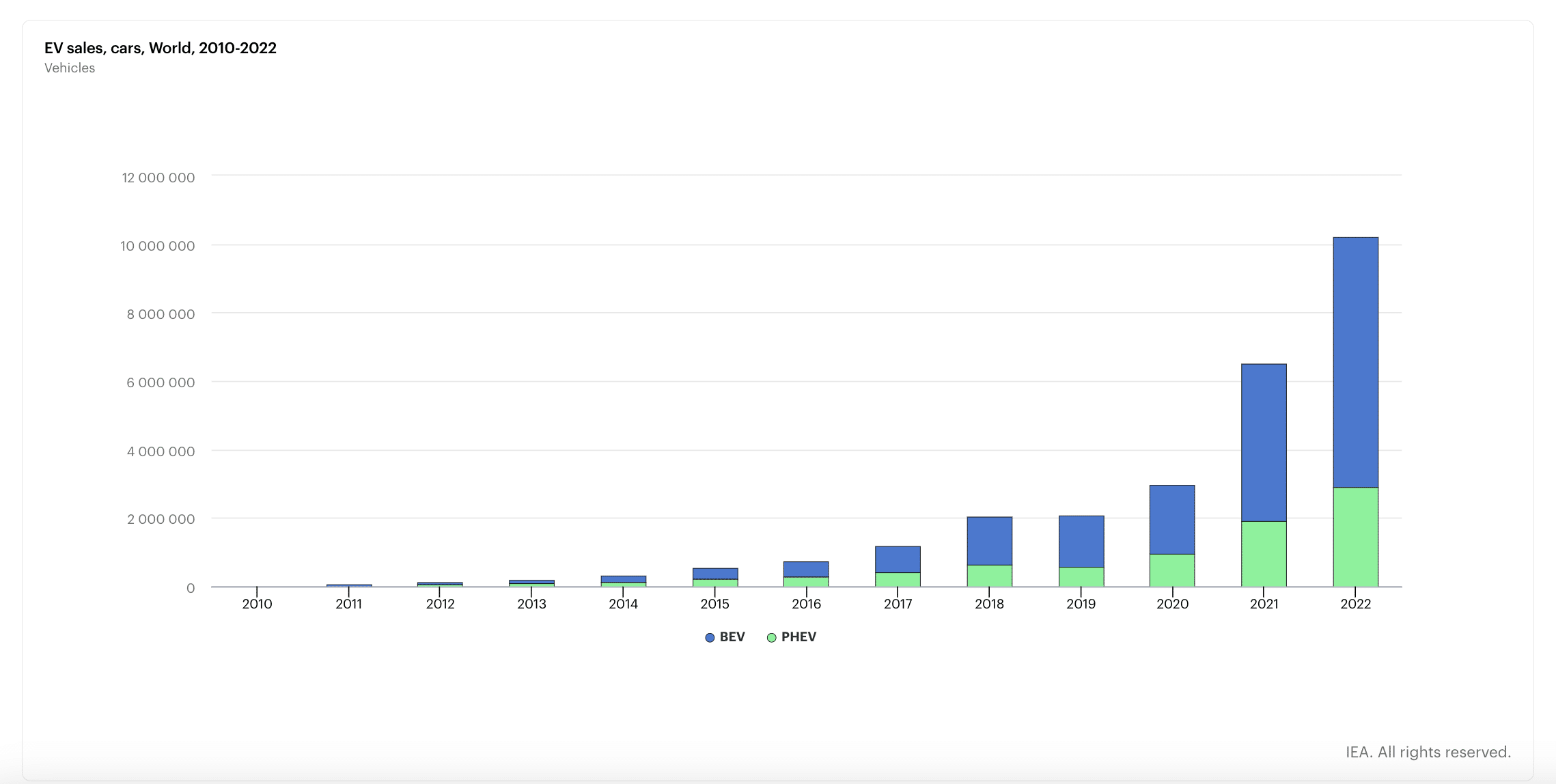

- From 2012 to 2022, the number of EVs sold each year worldwide showed a remarkable growth: from 18 thousand EVs sold in 2021 to 10.2 million sold in 2022 (IEA, 2023).

- Globally, the demand for electricity by EVs increased from around 2 thousand GWh in 2012 to 65 thousand GWh in 2022 (IEA, 2023).

- BYD, a Chinese automaker, has firmly established itself as a global leader in EV sales. In November 2023 alone, BYD sold around 289 thousand units (Clean Technica, 2024a).

- In the U.S., the Tesla Model Y accounted for 33% of all EVs sold in 2023 (Cox Automotive, 2024).

- In 2025, the number of EVs around the world is expected to total 76 million (IEA, 2023).

EV Statistics on Regional Market Growth

This section looks at the most recent EV stats for 2022, 2023, and 2024, giving a clear overview of how the EV market has changed and grown over the last ten years. The data, specifically focusing on electric cars (rather than any other vehicles), offers an in-depth look at the changes and growth in this sector.

The article breaks down the information by different regions – all over the world, the U.S., Europe, and China – focusing on things like the big surge in EV sales and the rising need for electricity.

Worldwide EV Statistics

From 2012 to 2022, the number of EVs sold each year worldwide showed a remarkable growth of 8,554% (IEA, 2023).

In 2012, 118 thousand EVs were sold. In 2022, the number of EVs sold skyrocketed to 10.2 million.

Globally, the share of EVs in total car sales grew from 0.2% to an impressive 14% between 2012 and 2022.

EV statistics also show that the total number of EVs worldwide saw a steep upward trend (+13,532%) in the same period (IEA, 2023).

In 2012, the stock of EVs around the world totaled 190 thousand, while in 2022, the figure reached 25.9 million.

In fact, the share of EVs in total cars around the world also increased from 0.02% to 2.1%, indicating a robust global uptake of EVs.

As a result, electricity demand for EVs has exploded by 2,855% (IEA, 2023).

Globally, the demand for electricity by EVs increased from around 2 thousand GWh in 2012 to 65 thousand GWh in 2022.

The U.S.

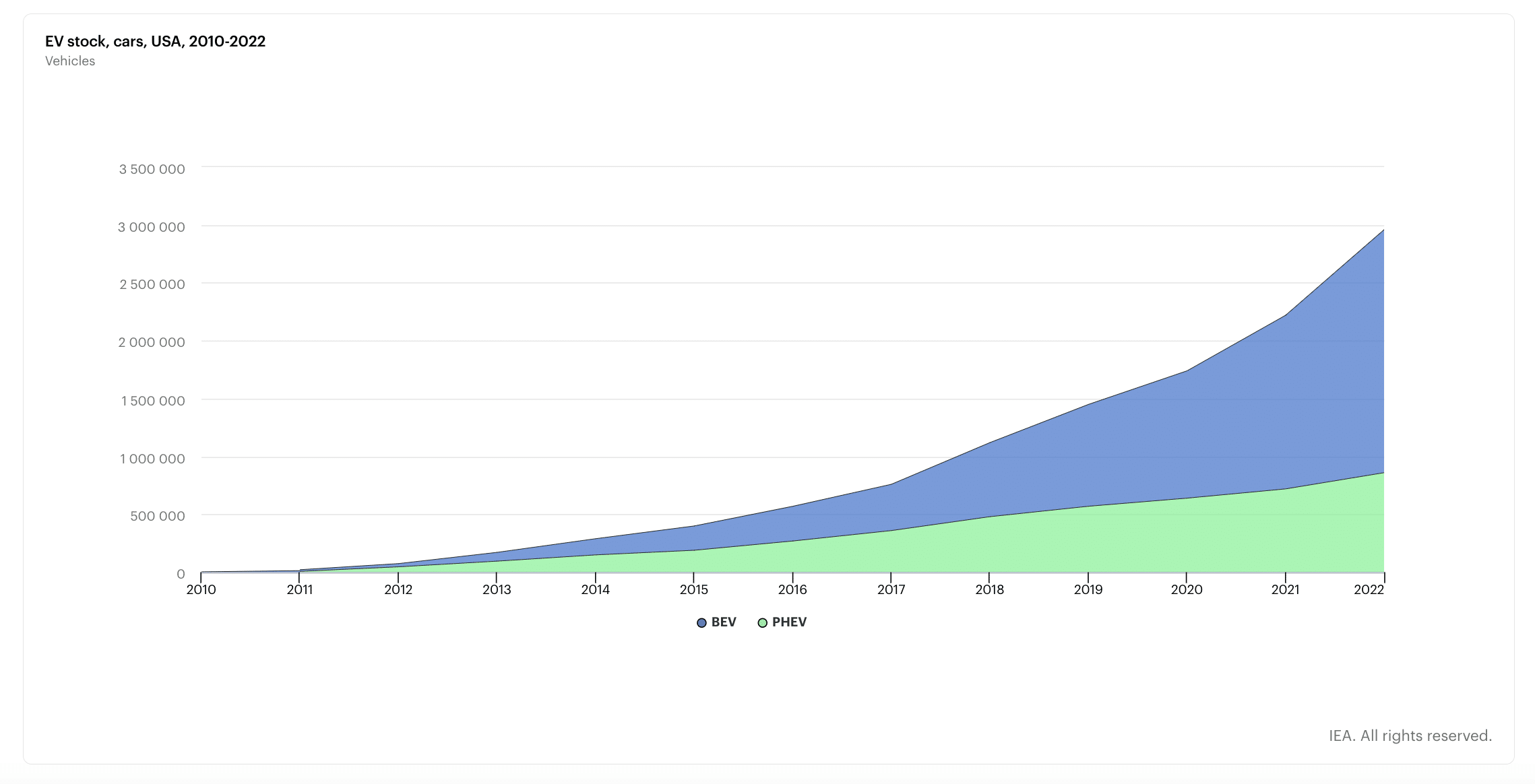

The number of EV sales in the U.S. increased by 1,733% between 2012 and 2022 (IEA, 2023).

From 54 thousand EVs sold in 2012, the U.S. saw growth to 990 thousand EVs sold in 2022, highlighting a burgeoning demand for cleaner transportation options.

In fact, the U.S. saw the share of EVs in total car sales grow from 0.4% to 7.7% over the same period.

The total number of EVs in the U.S. also skyrocketed by 3,713% between 2012 and 2022 (IEA, 2023).

In 2012, the U.S. had 75 thousand EVs in total. By 2022, this had grown impressively to 2.86 million, showing that more and more Americans are choosing electric.

As a result, the share of EVs in all cars in the U.S. grew from 0.03% to 1.3% over the same period.

Consequently, electricity demand for EVs grew by 4,900% between 2012 and 2022 (IEA, 2023).

It went up from 300 GWh in 2012 to 15 thousand GWh in 2022.

EV stats show that, economically, the U.S. is well-positioned to drive EV growth (Arthur Little, 2023).

- Economic Backbone: The U.S. has a strong economy with a GDP per capita surpassing US $76,000 and steady growth, providing a solid base for investing in EVs.

- Car Ownership: With 830 cars owned per 1,000 people in the U.S., there’s a large potential market for EVs.

- Tech Adoption: The U.S. is third in global innovation rankings, showing its eagerness to embrace new technologies like EVs.

- Government Incentives: Tax breaks from the Inflation Reduction Act are giving a boost to the EV industry in the U.S.

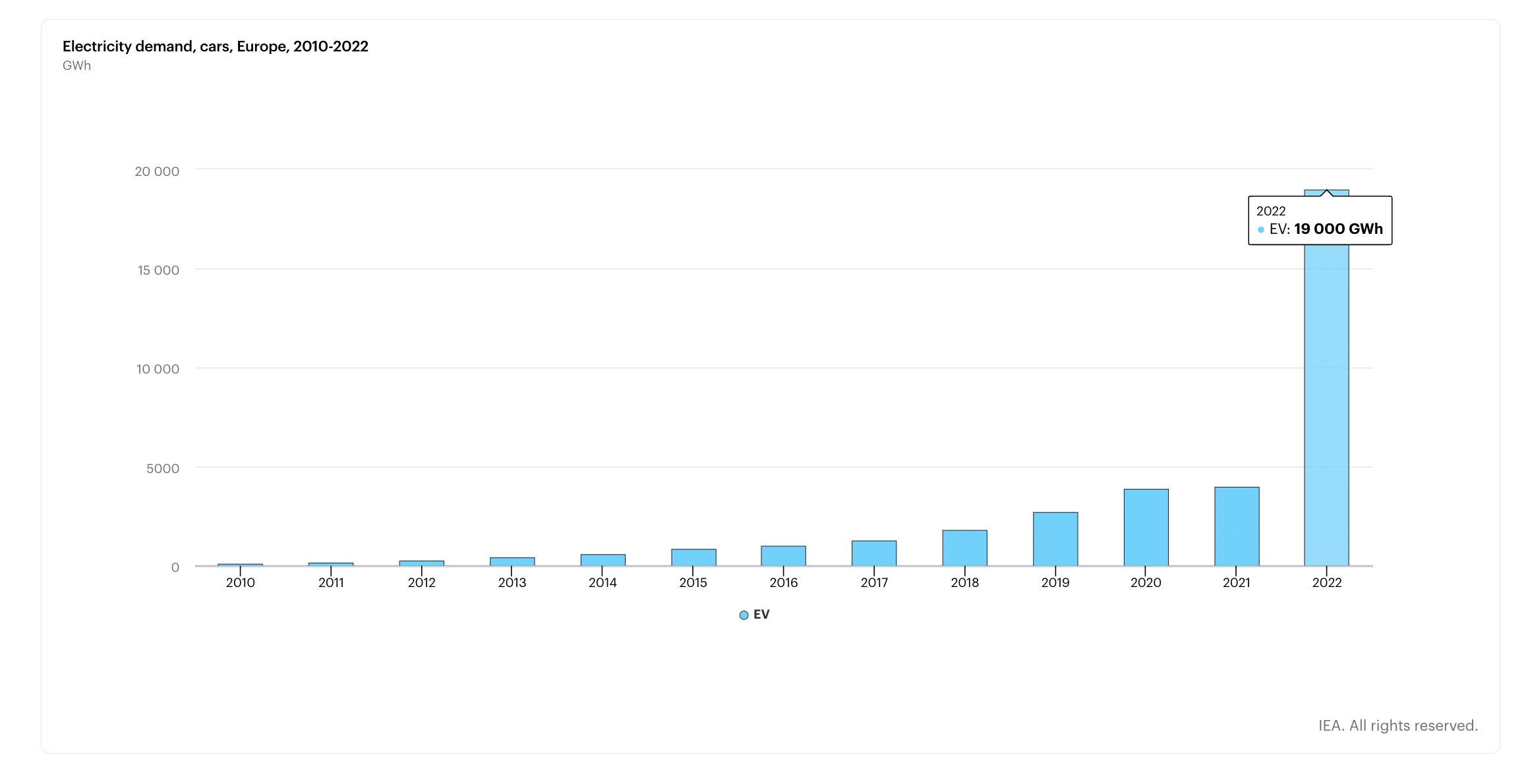

Europe

The number of EV sales in Europe exploded by 9,530% between 2012 and 2022 (IEA, 2023).

EV sales in Europe leaped from 27 thousand in 2012 to 2.6 million in 2022, underscoring the rapid consumer shift to EVs over the past ten years.

In fact, EVs made up nearly a quarter (21%) of all car sales in Europe in 2022. This was a significant leap compared with 2012, when EVs made up a modest 0.2%.

The total number of EVs across Europe increased by 16,602% in 2022 compared with 2012 (IEA, 2023).

EV statistics show that Europe’s EV stock surged from 47 thousand in 2012 to a staggering 7.8 million in 2022, showcasing Europe’s leading edge in the global shift towards electric mobility.

In fact, 2.4% of all cars in Europe were EVs in 2022. The share of EVs in all cars in Europe was a mere 0.02% in 2012.

Consequently, electricity demand for EVs in Europe surged by 7,817% over the same period, mirroring the surge in EV adoption (IEA, 2023).

It surged from 240 GWh in 2012 to 19 thousand GWh in 2022, reflecting the region’s aggressive adoption of electric mobility.

China

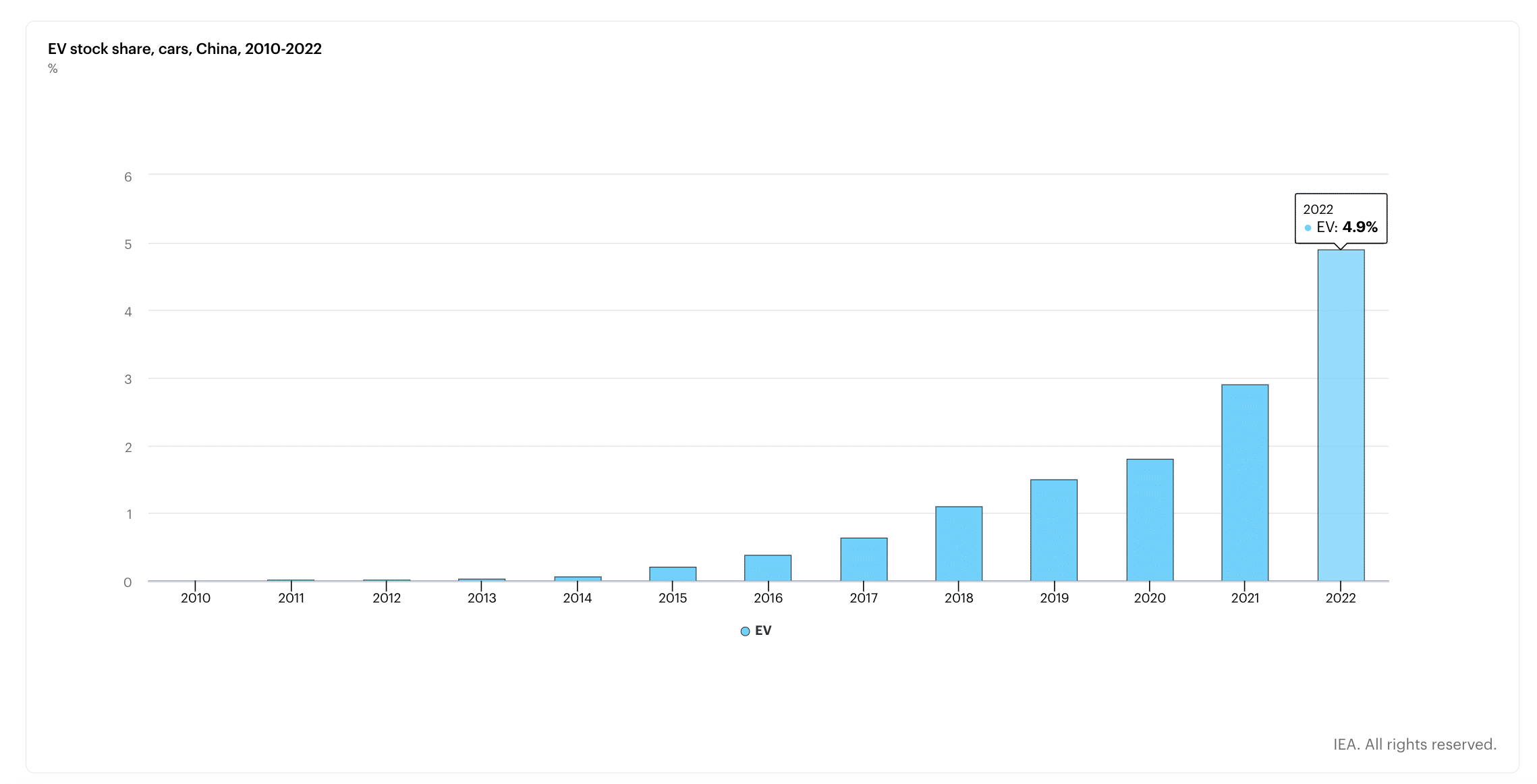

The EV landscape in China has witnessed an astronomical surge over the past decade. Between 2012 and 2022, EV sales in China escalated by a staggering 58,900% (IEA, 2023).

From nearly 10 thousand EVs sold in 2012, the number rocketed to an impressive 5.9 million in 2022.

Moreover, the share of EVs in total car sales in China has seen a substantial increase. In 2012, EVs accounted for approximately 0.07% of all car sales. By 2022, this figure had soared to 29%.

The total number of EVs in China also experienced a remarkable expansion, growing by 82,841% from 2012 to 2022 (IEA, 2023).

The EV stock in China rose from nearly 17 thousand in 2012 to a monumental 14.1 million by 2022.

In fact, in 2022, EVs represented 4.9% of all cars in China, a substantial growth from a mere 0.02% in 2012.

As a result, the electricity demand for EVs in China experienced a significant increase of 3,025% during this period, reflecting the rapid adoption of EVs (IEA, 2023).

EV statistics show that this demand rose from 800 GWh in 2012 to 25 thousand GWh in 2022, indicating the region’s enthusiastic embrace of electric mobility.

EV Market Leaders and Best-Selling Models

This section of the article explores the big names in the EV world and their impressive sales around the globe. This section explores EV stats on the major players in the EV market, like the successful Chinese company BYD and the well-known Tesla, to see how they are leading in EV sales worldwide.

Then, the article zooms in on the top EV models that are making waves in two important markets: the U.S. and Europe. It explores which EV models are selling the best and how brands like Tesla in the U.S. and Skoda and Audi in Europe are becoming favorites among electric car buyers.

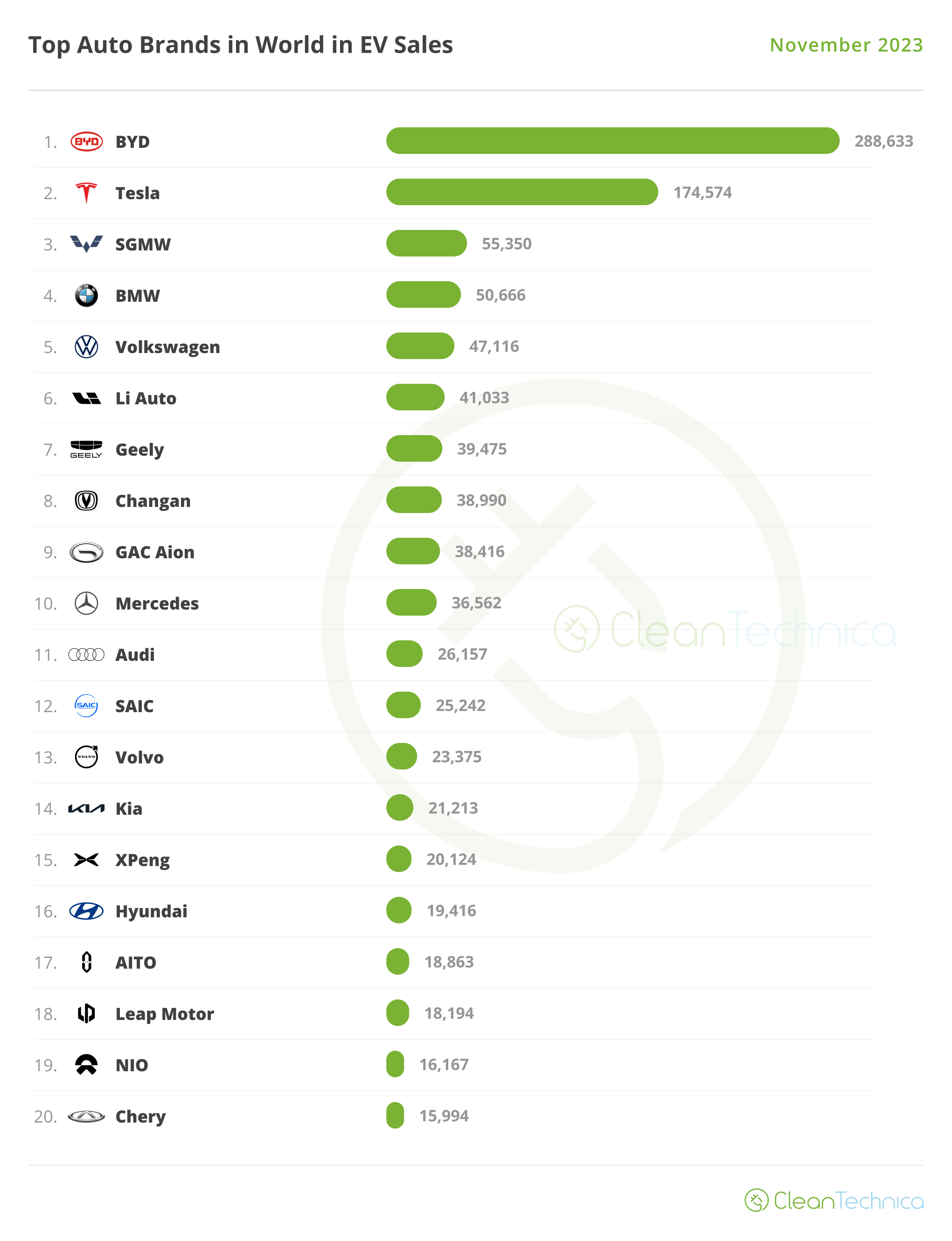

Leading Global EV Brands

BYD, a Chinese automaker, has firmly established itself as a global leader in EV sales (Clean Technica, 2024a).

In November 2023 alone, BYD sold around 289 thousand units. Its continued success is marked by record-breaking performances and a diverse lineup of electric vehicles.

Tesla, the American EV pioneer, maintains a strong presence in the market (Clean Technica, 2024a).

It delivered about 174 thousand units in November 2023, which was 14% higher than the same period in 2022. Ultimately, EV statistics show that Tesla’s consistent innovation and global brand recognition keep it at the forefront of the EV industry.

The SGMW JV, a lesser-known but impactful player, secured the third spot in the market (Clean Technica, 2024a).

Its success is driven by popular models like the Wuling Mini EV and Bingo, resulting in selling more than 55 thousand units in November 2023.

German automakers BMW and Volkswagen, ranking fourth and fifth, respectively, also posted their best results of the year (Clean Technica, 2024a).

In November 2023, BMW sold nearly 51 thousand units, while Volkswagen followed closely with around 47 thousand units, indicating potential record-breaking performances in December.

Li Auto, a rising Chinese brand, continues to break its own records (Clean Technica, 2024a).

With over 41 thousand units sold, it marked its eighth consecutive record month in November 2023. EV stats hint at continued growth, especially with new models like the L6 SUV and L5 sedan.

Changan and Geely, ranking eighth and seventh, respectively, each hit record sales numbers (Clean Technica, 2024a).

Both brands sold around 39 thousand units in November 2023. Geely’s success was bolstered by models like the Panda Mini and the Galaxy L7.

Audi, Volkswagen’s premium brand, achieved its best result throughout 2023, with around 26 thousand units sold in November 2023 (Clean Technica, 2024a).

However, it trails behind BMW in the EV market, partly due to a smaller range of EV models.

Top Selling EV Models in the U.S.

Tesla maintained its dominant position, with its range of models consistently outperforming others in sales (Cox Automotive, 2024).

The Tesla Model Y, known for its versatility as a crossover, secured a top position with remarkable sales figures. In 2023, Tesla sold more than 394 thousand Model Ys. This means that the Model Y accounted for 33% of all EVs sold in 2023.

The Tesla Model 3 followed as the second top-most-selling EV in the U.S. in 2023. Tesla sold nearly 221 thousand vehicles of this model.

The Chevrolet Bolt EV was another key player, as the third-most-popular model sold in the U.S. in 2023 (Cox Automotive, 2024).

Its reasonable price and practicality made it a popular option, showing Chevrolet’s successful move into the EV market. The year 2023 saw over 62 thousand Chevy Bolt EVs being sold in the U.S.

The Ford Mustang Mach-E also did well, with rising sales (Cox Automotive, 2024).

This model combines classic Mustang features with new EV technology, and people have responded positively. EV stats reveal that Ford recorded nearly 41 thousand units of this model being sold.

Adding to the list, the Volkswagen ID.4 made a significant impact (Cox Automotive, 2024).

Volkswagen sold nearly 38 thousand units of this model. Its blend of innovation and efficiency has resonated well with consumers, marking it as a strong contender in the EV market.

The Hyundai Ioniq 5 also showed impressive performance (Cox Automotive, 2024).

With sales of nearly 34 thousand units in 2023, its eco-friendly design and advanced technology have made it a popular choice among EV enthusiasts.

Top Selling EV Models in Europe

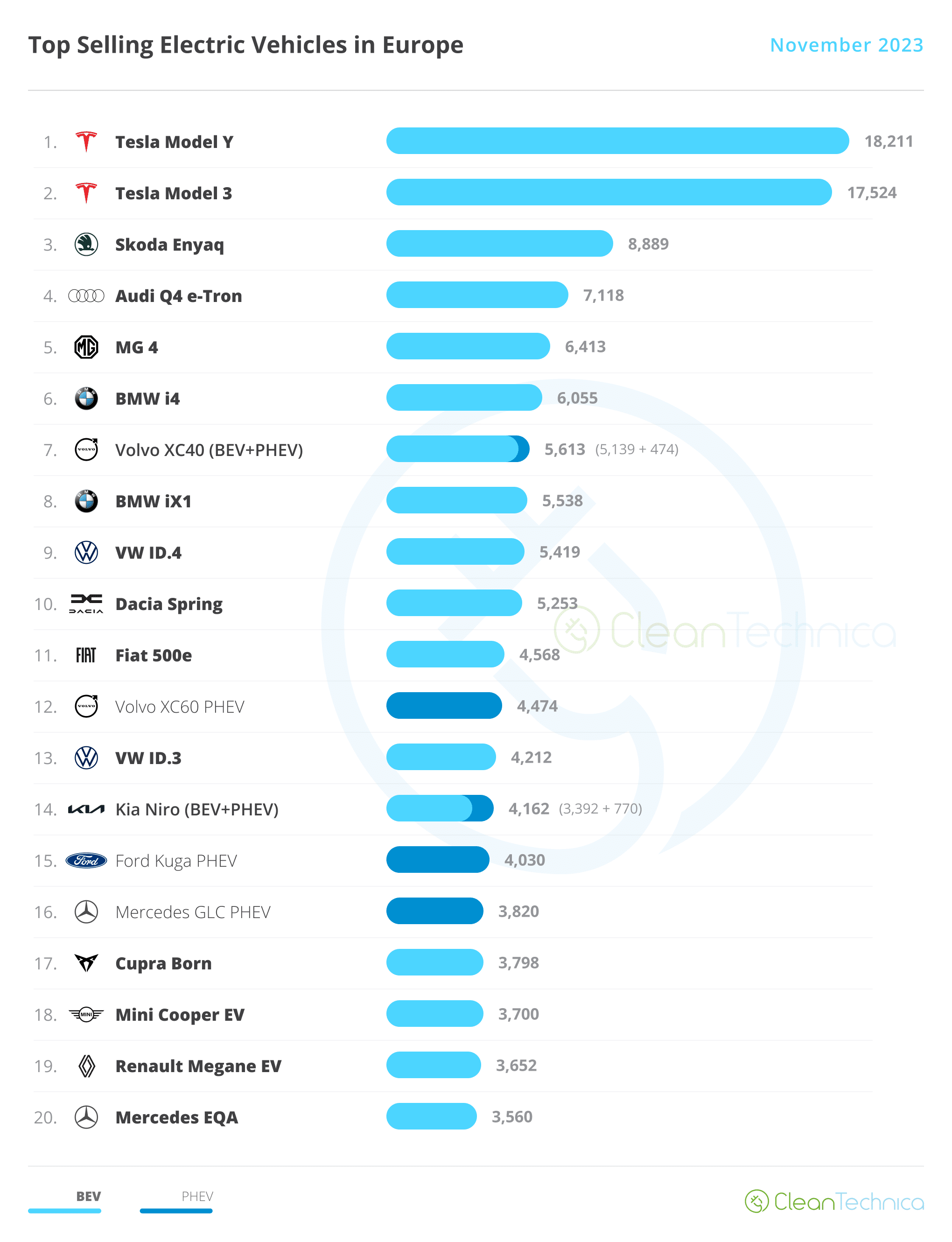

Tesla, the U.S.-based EV maker, stayed on top in Europe’s EV market (Clean Technica, 2024b).

The Tesla Model Y, their crossover vehicle, was Europe’s number one EV in November 2023, with over 18 thousand sold. However, it sold 7% less than last year.

Tesla’s Model 3 sedan also did well, with nearly 18 thousand sold in November, up 43% from the previous year.

Czech car manufacturer Skoda is gaining ground in the EV market with its Enyaq model (Clean Technica, 2024b).

In November 2023, Skoda Enyaq sales reached nearly 9 thousand, marking another successful month and showing growing popularity.

German luxury brand Audi’s compact EV, the Q4 e-tron, is becoming more popular in Europe (Clean Technica, 2024b).

November 2023 saw over 7 thousand Q4 e-trons sold, mainly in the UK, Germany, Belgium, and Sweden.

MG’s hatchback, the MG4, is challenging other compact EVs in Europe with its attractive price (Clean Technica, 2024b).

It made it into the top 5 with over 6 thousand sales in November 2023. EV statistics reveal that it was especially popular in France, Germany, and the Netherlands.

German brand BMW is seeing success with its electric models, the i4 and iX1 (Clean Technica, 2024b).

The BMW i4 reached a new high with over 6 thousand sales, and the iX1 followed with 5,538 in November 2023.

Volvo’s XC60 PHEV model became the top-selling plugin hybrid in November (Clean Technica, 2024b).

It set a record with over 4 thousand units sold, showing Volvo’s strength in the hybrid market.

EV Brand Landscape: Upcoming Trends and Model Forecasts for 2024

The EV sector is poised for fascinating developments and shifts. This section delves into the dynamics of the EV market, focusing on how different brands and their models are expected to perform in the upcoming year.

Looking ahead to the global prospects for EVs in 2024, it seems that BYD and Tesla will keep growing but at a more controlled pace.

- BYD’s Strategy: This Chinese giant is nearing its peak in its home market, making it challenging to grow significantly in international markets. BYD’s focus for 2024 is likely on maintaining profitability while expanding into premium segments.

- Tesla’s Challenges: Tesla faces limitations with its aging vehicle lineup. The much-anticipated Cybertruck is still under intense development, and even if it contributes an additional 100 thousand –200 thousand units to Tesla’s sales in 2024, this increment won’t significantly impact the company’s overall sales volume. Major growth for Tesla is expected in 2025 with the launch of a new compact model.

- Volkswagen Group and SAIC: These two brands might be in a tight race for the fourth spot, as they’re unlikely to challenge for third. This is due to the impressive growth trajectory of Geely-Volvo.

- Geely–Volvo’s Rise: Currently on an upward trend, Geely-Volvo is poised to become a key player in 2024. The conglomerate is bolstering its portfolio with promising models from its diverse brands, including Geely’s Galaxy sub-brand, Volvo’s EX30 and EX90, Zeekr’s 007, Lynk & Co’s forthcoming EVs, and Polestar’s models 3 & 4. This expansion positions Geely-Volvo as a potential bronze medalist in the BEV (Battery Electric Vehicle) rankings for 2024.

(Clean Technica, 2024a)

The Future Outlook: EV Market Trends and Predictions

Looking ahead, the future of EVs is shaping up to be both exciting and game-changing. In this section, the article examines EV statistics on what’s expected for the EV market in the coming years, focusing on different parts of the world – globally, in the U.S., Europe, and China.

This section explores the projected numbers for EV sales, how many EVs will be on the roads, and the increasing need for electricity to power these vehicles. Covering the years up to 2025 and 2030, these predictions provide a sneak peek into how EVs are set to grow and become even more important in the world’s car markets.

Worldwide EV Statistics

In 2025, the IEA projects that 20.5 million EVs will be sold worldwide (IEA, 2023).

It also projects that 2030 will see 36.9 million EV sales (+80% compared with 2025).

Furthermore, in 2025, the number of EVs around the world is expected to total 76 million (IEA, 2023).

By 2030, the figure is expected to reach 226 million (+197% compared with 2025).

As a result, the electricity demand for EVs is expected to total 200 thousand GWh in 2025 (IEA, 2025).

By 2030, demand is expected to surge to 570 thousand GWh (+185% compared with 2025).

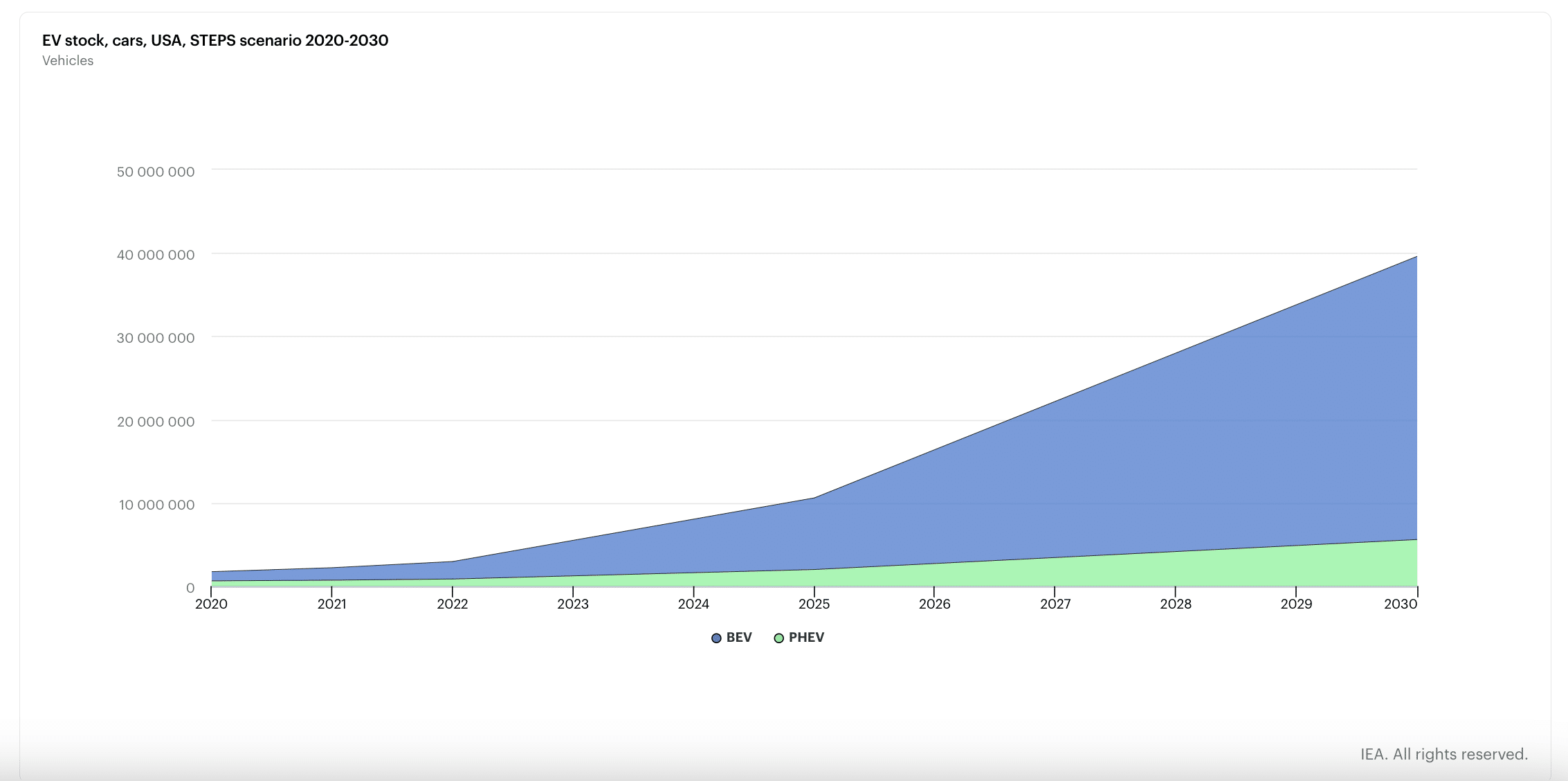

The U.S.

By 2025, the U.S. is expected to sell 3.34 million EVs (IEA, 2023).

Looking ahead to 2030, sales are projected to reach 7.76 million (+132% compared with 2025)

The total U.S. EV stock is set to hit 10.6 million by 2025 (IEA, 2023).

By 2030, the total number of EVs is predicted to soar to 39.6 million (+274% compared with 2025).

In 2025, the U.S. is expected to see a 54 thousand GWh demand in electricity for EVs (IEA, 2023).

The figure is expected to reach 180 thousand GWh by 2030 (+233% compared with 2025).

Europe

In 2025, the IEA projects that Europe will sell 5.2 million EVs (IEA, 2023).

The growth trajectory steepens as 2030 approaches, with sales expected to reach 9.6 million (+85% compared with 2025).

Europe’s commitment to electric mobility is clear, with an EV stock projection of 21.3 million by 2025 (IEA, 2023).

The 2030 forecast is even more striking: 56 million EVs (+163% compared with 2025).

Electricity demand for EVs in Europe is projected to reach 54 thousand GWh in 2025 (IEA, 2023).

It is expected to climb to 130 thousand GWh by 2030 (+141% compared with 2025).

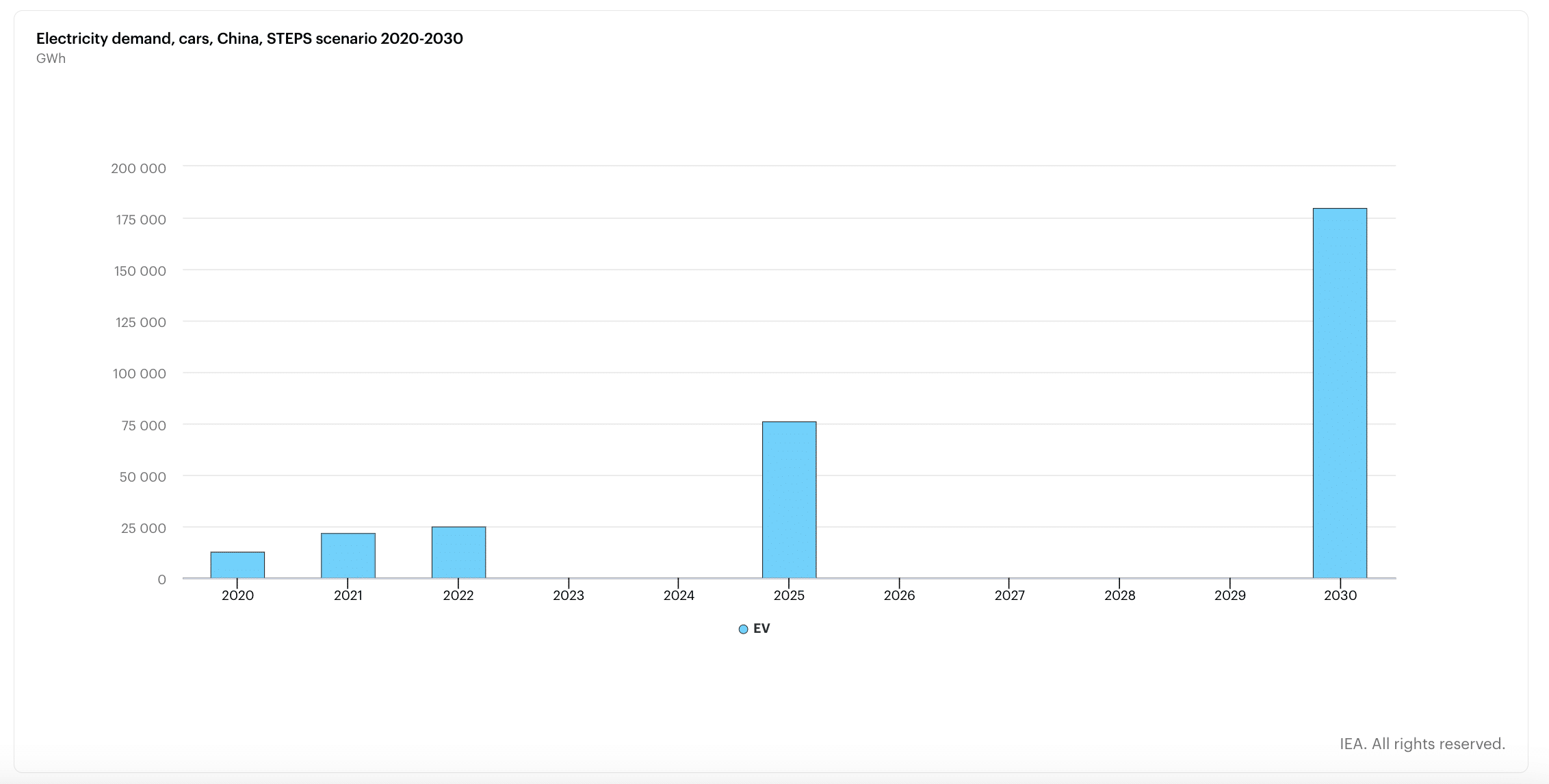

China

In China, it is projected that 9.7 million EVs will be sold in 2025 (IEA, 2023).

Sales are anticipated to increase to 14.6 million in 2030 (+51% compared with 2025).

Moreover, the total number of EVs in China is expected to be around 39.2 million in 2025 (IEA, 2023).

This number is forecasted to rise to 103 million by 2030 (+163% compared with 2025).

Consequently, the electricity demand for EVs is projected to be 76 thousand GWh in 2025 (IEA, 2023).

By 2030, this demand is expected to escalate to 180 thousand GWh (+137% compared with 2025).

The Bottom Line

In conclusion, the EV statistics outlined in this article illustrate the electric vehicle market’s rapid expansion and transformation globally. The steep growth in EV sales, the notable rise in global EV ownership, and the escalating demand for electricity are indicative of a major move towards electric mobility.

The future of EVs is not just a trend but a central component of the shift in transportation. With new, innovative models and strategies from leading manufacturers, the EV market is poised for continued growth, signaling a move towards a greener and more sustainable future in transportation.

References

- Glossary (European Alternative Fuels Observatory)

- Glossary: Gigawatt hours (GWh) – Statistics Explained (European Commission)

- 1st & 2nd Place Wins for Tesla in Europe (CleanTechnica)

- Global Electric Mobility Readiness Index 2023 (Arthur D. Little)

- Top Electric Vehicle Brands in the World — BYD & Tesla in a Different Universe (CleanTechnica)

- Electric Vehicle Sales Report — Q4 2023 (Cox Automotive)

You must be logged in to post a comment.